Climate insurance for farmers: a shield that boosts innovation

New insurance products geared towards smallholder farmers can help them recover their losses, and even encourage investment in climate-resilient innovations.

New insurance products geared towards smallholder farmers can help them recover their losses, and even encourage investment in climate-resilient innovations.

What stands between a smallholder farmer and a bag of climate-adapted seeds? In many cases, it’s the hesitation to take a risk. Farmers may want to use improved varieties, invest in new tools, or diversify what they grow, but they need reassurance that their investments and hard work will not be squandered.

Climate change already threatens crops and livestock; one unfortunately-timed dry spell or flash flood can mean losing everything. Today, innovative insurance products are tipping the balance in farmers’ favor. That’s why insurance is featured as one of 10 innovations for climate action in agriculture, in a new report released ahead of next week’s UN Climate Talks. These innovations are drawn from decades of agricultural research for development by CGIAR and its partners and showcase an array of integrated solutions that can transform the food system.

Index insurance is making a difference to farmers at the frontlines of climate change. It is an essential building block for adapting our global food system and helping farmers thrive in a changing climate. Taken together with other innovations like stress-tolerant crop varieties, climate-informed advisories for farmers, and creative business and financial models, index insurance shows tremendous promise.

The concept is simple. To start with, farmers who are covered can recoup their losses if (for example) rainfall or average yield falls above or below a pre-specified threshold or ‘index’. This is a leap forward compared to the costly and slow process of manually verifying the damage and loss in each farmer’s field. In India, scientists from the International Water Management Institute (IWMI) and the Indian Council of Agricultural Research(ICAR), have worked out the water level thresholds that could spell disaster for rice farmers if exceeded. Combining 35 years of observed rainfall and other data, with high-resolution satellite images of actual flooding, scientists and insurers can accurately gauge the extent of flooding and crop loss to quickly determine who gets payouts.

The core feature of index insurance is to offer a lifeline to farmers, so they can shield themselves from the very worst effects of climate change. But that’s not all. Together with my team, we’re investigating how insurance can help farmers adopt new and improved varieties. Scientists are very good at developing technologies but farmers are not always willing to make the leap. This is one of the most important challenges that we grapple with. What we’ve found has amazed us: buying insurance can help farmers overcome uncertainty and give them the confidence to invest in new innovations and approaches. This is critical for climate change adaptation. We’re also finding that creditors are more willing to lend to insured farmers and that insurance can stimulate entrepreneurship and innovation. Ultimately, insurance can help break poverty traps, by encouraging a transformation in farming.

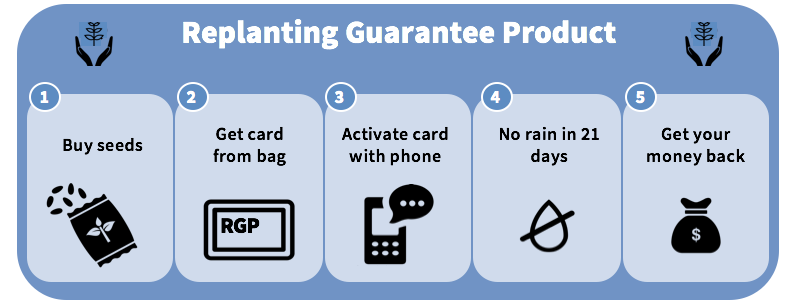

Insurers at the cutting edge are making it easy for farmers to get coverage. In Kenya, insurance is being bundled into bags of maize seeds, in a scheme led by ACRE Africa. Farmers pay a small premium when buying the seeds and each bag contains a scratch card with a code, which farmers text to ACRE at the time of planting. This initiates coverage against drought for the next 21 days; participating farms are monitored using satellite imagery. If there are enough days without rain, a farmer gets paid instantly via their mobile phone.

Farmers everywhere are businesspeople who seek to increase yields and profits while minimizing risk and losses. As such, insurance has widespread appeal. We’ve seen successful initiatives grow rapidly in India, China, Zambia, Kenya and Mexico, which points to significant potential in other countries and contexts. The farmers most likely to benefit from index insurance are emergent and commercial farmers, as they are more likely than subsistence smallholder farmers to purchase insurance on a continual basis.

It’s time for more investment in index insurance and other innovations that can help farmers adapt to climate change. Countries have overwhelmingly prioritized climate actions in the agriculture sector, and sustained support is now needed to help them meet the goals set out in the Paris Climate Agreement.

Jon Hellin leads the project on weather index-based agricultural insurance as part of the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS). This work is done in collaboration with the International Research Institute for Climate and Society (IRI) at Columbia University, and the CGIAR Research Programs on MAIZE and WHEAT.

Find out more

Report: 10 innovations for climate action in agriculture

Video: Jon Hellin on crop-index insurance for smallholder farmers

Report: Scaling up index insurance for smallholder farmers: Recent evidence and insights.

Website: Weather-related agricultural insurance products and programs – CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS)